고정 헤더 영역

상세 컨텐츠

본문

- Can't Reconcile Manual Transaction In Quicken For Mac 2017

- Can Reconcile Manually Transactions In Quicken For Mac

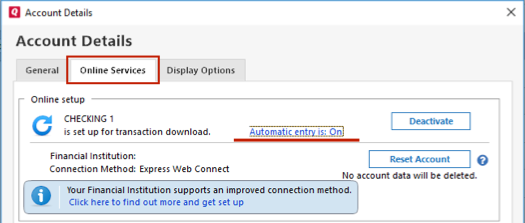

The transactions available for Manual Match were the same transactions available for 'Match'. Transactions that had never been downloaded (either as 'New' transactions, or 'Match'ed by downloaded transactions). Transactions that Quicken believed had been downloaded before were not available for matching.

Quicken was traditionally known as one of the best personal finance software options for desktop users. However, the Mac version had traditionally lacked the features found in the PC version, and that was disappointing to many users. While last year's version was a big improvement, it still wasn't there for everyone.

After using Quicken for Mac 2019 for several weeks, we're happy to see that Quicken has continued the improvements over prior years. It's not as robust as we'd like to see yet, but it's definitely been moving in the right direction.

So, how did Quicken for Mac 2019 do? Honestly, it's an incremental improvement over 2018. But we like the direction it's going, and if you can get a great deal on pricing (which you typically can on or when they have a sale), it could be worth it. Key Features Of Quicken For Mac 2019 Quicken For Mac continues to build on the many traditional features that Quicken users expect. As always, it comes with great spending tracking (compared to other online options like and ), it has investment tracking, and budgeting. For 2019, they have improved the usability of the platform, but the navigation is still a little challenging.

Even after using Quicken for about a week, I still find it hard to get to different reports. It's not intuitive. They also improved the web interface for Quicken.

If you don't want to use the desktop software, and prefer a web version (like what you get with Mint), you can have that now. But I prefer the app over the web version.

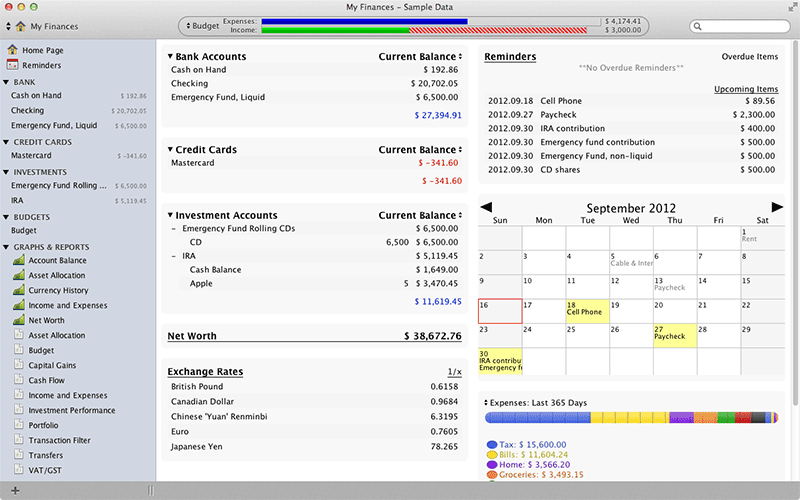

Here's what the home screen looks like. The pricing for Quicken For Mac 2019 continues to be a focus point for most users. Quicken changed their pricing model last year to a subscription-based model, instead of a one-time fee.

I see this as both good and bad. It's bad, because many Quicken users kept their software for years, and never upgraded. For users, this was fine - because you could avoid bad rollouts like Quicken for Mac 2017. However, to continue to receive updates and banking information, you had to update every few years anyway or Quicken would cut you off.

It's good, because my hope is with more recurring revenue, Quicken can continue to improve their software and ensure banking connectivity. Quicken For Mac 2019 has three price points this year. I think 90% of users would benefit simply using the Deluxe version, which is $49.99/yr at full price. Here's what the pricing looks like. It's hard to say if Premier is worth the huge additional price.

I think Deluxe is the best value, for the added features of investment and loan tracking. But I've never used BillPay, and I highly recommend that most people don't use a service like BillPay because not only does Quicken charge more, but many banks charge for the service as well. Note: For Windows, there is also a Home and Business version. However, we think most consumers with a small business would benefit more from using a tool like, versus using Quicken Home and Business. Special Promotional Pricing As you probably already know, Quicken is notorious for running promotional pricing all the time. Recently, they were offering 40% off their prices - which I think is a fair price for the product.

I would have a hard time paying $49.99 per year for Deluxe, but paying $29.99 per year makes much more sense - especially considering that I would typically upgrade every 2-3 years, this aligns much better with the pricing I'd expect. However, in our search for deals, we found that Amazon.com is offering a 14-month subscription of the Deluxe version for $38.49 (which is 30% off full price). Given the $49.99 price is $4.17 per month, Amazon's deal is $2.75 per month. Still not as good as Quicken's own sale, but the second best deal we've found. Quicken World Mastercard Another interesting product/feature that Quicken launched this year is the Quicken World Mastercard.

The Quicken credit card provides real-time transaction notifications in the Quicken mobile app, and offers integration with Quicken for Mac desktop. This card also gives you a free year of Quicken Deluxe when you spend at least $500 in the first 90 days. If you already have a subscription, you'll get a 1 year extension. The card offers 2x rewards points on all your qualified spending, and has no annual fees. Given that this card is really about integration with Quicken, we're surprised that you don't get Quicken free every year as long as you spend at least $500 per year. Otherwise, all the rewards are on par or below the other. 20 Shares Filed Under: Tagged With: Editorial Disclaimer: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, airlines or hotel chain, or other advertiser and have not been reviewed, approved or otherwise endorsed by any of these entities.

Comment Policy: We invite readers to respond with questions or comments. Comments may be held for moderation and are subject to approval. Comments are solely the opinions of their authors'. The responses in the comments below are not provided or commissioned by any advertiser. Responses have not been reviewed, approved or otherwise endorsed by any company. It is not anyone's responsibility to ensure all posts and/or questions are answered.

About Robert Farrington. Robert Farrington is America's Millennial Money Expert, and the founder of, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him One of his favorite tools is, which enables him to manage his finances in just 15-minutes each month. Best of all - it's free!

He is also diversifying his investment portfolio by adding a little bit of real estate. But not rental homes, because he doesn't want a second job, it's diversified small investments in a mix of properties through. Worth a look if you're looking for a low dollar way to invest in real estate. You’re totally right on that long term value – that’s why I’m not sure at full price.

However, at $29.99, now we’re talking $300 over 10 years – which is on par with what Quicken users have been paying for the last 10-15 years anyway with required upgrades. You have to remember, Quicken pays to have access to that bank connectivity. I’ve heard it costs about $1 per account per year for a service like Quicken. When you think that the average user probably has 5-10 accounts linked, their ongoing data expense alone is $5-10 per each user.

It makes sense that on that cost alone they can’t offer bank connectivity forever at a single one time fee. I’m concerned about the inability to track “Transfers” to loan accounts in the Budgeting function. Our family was setting up a budget that involved 13 loans including 11 student loans that have to be paid for out of our checking accounts every month. This obligation is a substantial portion of our family budget, yet cannot be tracked with the latest version of the Quicken Deluxe for the Mac platform.

Many other users in the Users Forum complain about this deficiency and Quicken promises that they are aware of it and plan to make changes. Is this a fatal flaw for families that need to budget loan payments, or are you aware of a workaround that will address this problem. So I’m confused. Is it because when you setup the loan, it only counts the interest as the expense and not the full amount (since part of it was a transfer)? What I’ve found to work is renaming the split (I had to do this in prior versions of Quicken as well, and early versions with Credit Card Payments even) – “Student Loan Payment”.

You could even get specific by loan type. It looks like this: Then, when you go into your spending and budgeting, you can see it here – just look at the line for both Student Loan Payment and Loans (which is interest and I could also rename). I have been using Quicken Mac 2007 for all this time because my stock data has multiple lots with different purchase dates. I bought the 2018 edition because they claimed it will handle multiple lots — and it does, though the import had a few glitches which I was able to work around. But I’m sorry I spent the time doing that, as the 2018 version is severely crippled. It won’t even let you print or export a simple “portfolio value report”: about the most basic function I can imagine; all you can do is look at it onscreen. Custom reports are all about transactions, not current holdings and values.

It claims to generate exportable files for transfer to Q Mac 2007 and for Q Windows, but neither of them worked. So your data goes in, but you can’t get it out, which doesn’t satisfy their “data guarantee.” I discovered this a few days after the 30-day money back period, but was able (after hours unsuccessfully trying to reach a chat agent, and half an hour of phone hold) to get them to refund my purchase price, but I’ll never get back the time I spent fixing the data importing or trying to make it do what it ought to do. I would advise everyone to avoid this product. Quicken Mac 2018 is a glorious flaming waste of time if you want a semblance of tracking investments. I have been using Quicken Mac since 2004.

I have diligently been forced into upgrading purely because mac has improved with time and no longer can run older versions of Quicken. I am now on the 3rd round of customer service calls. (I installed Mac 2018 this morning.) I am an expert Quicken user and know my way around my mac.

Importing my data file was a breeze. Thanks for that. My issue – when I sell shares of a security, it doesn’t update in the portfolio or cash. Three rounds of customer service and I am now asked to enter a transaction to sell shares. And a transaction to remove shares.

And a transaction to add a ghost “placeholder.” And if its a full moon maybe your shares will actually appear correctly. The other option is to go into your account and delete every possible transaction relating to the security you just sold. Compliance and data integrity nightmare. The graphics are fun and pretty just don’t actually use the data generated. Back to the drawing board quicken. $50 annual fee? Thats laughable!

I have been using Quicken 2007 for 11 years. I pay my bills with Quicken, and reconcile my checkbook by downloading bank transactions with Quicken. I believe that at one time, I paid my bank a monthly fee for this privilege, but as far as I can tell, I pay nothing now.

How is Quicken 2018 different in this regard? Once upon a time, I reconciled my credit cards by downloading transactions from my credit card companies. I stopped doing that some time ago, but should I wish to start up again, does Quicken 2018 support that, and is there a charge for that?

I would just continue to use Quicken 2007, but I am concerned about the upcoming abandonment of 32 bit applications by Apple. Quicken 2019 has a dreadful user interface.

GONE is the ability to run simple reports for this year, last year, date-to-date, etc. With any ease, if at all. GONE is the simple accounts window that you are used to.

GONE is the empty register line at the bottom of your account window waiting for you to fill in the newest transaction (you have to use a “+” “New Transaction” clumsy interface now). I could go on. The people who revamped this app appear to have done ZERO research with real world users. The investment firm who bought Quicken?

They’re doing nothing good here. I am one of thousands or millions stuck in Quicken 2007 and LIKE the interfaces in that version.

Why can’t Quicken LISTEN to all the people screaming how unhappy they are with this product? I could care less about the online features. It’s just not there yet and I would never use it anyway. I have my stuff in the cloud, it’s fine. I use Quicken on a desktop or laptop so the phone app is of no use for me. It’s fine to build that in for those who like it. But you have to perfect, as best as you can, the actual application first and foremost.

Quicken has become bloated and unintuitive over the last few versions. They’ve lost sight of the original idea and purpose. This is simple bookkeeping.

And simpler, is BETTER, when it comes to accounting software. Graphs, charts, and icons are fine, but can we please have the ability to turn them off. I don’t want to look at all the clutter constantly. Give me an accounts window (without the unnecessary folders for cash, cc, investments), individual account windows when I open them, keep the legacy register format that has been used for many decades (it just plain works and makes sense, newest on the bottom, empty one at bottom ready to be filled in), a way to run reports the way it’s done in 2007 (again, simple, makes sense, easy to get what you want out of it).

STOP the incessant altering and revamping. It does not work as well for the end users. Capital, sell this software to someone who gets it and will rework with some thoughtful acumen and intelligence.

Forget the subscription plan too. It’s insulting. People upgrade as needed every couple years or so without be forced into it. Subscription methods set a bad tone between the company and it’s users. Allow users the respect to upgrade when they choose rather than strong-arming them into it from the get go.

Last Updated: November 30, 2018 If you’ve finally had it with the Mac version of, we’ve taken a closer look at the best personal finance software for Mac of 2018. Quicken for Mac has lagged behind the Windows version for years and even though (and the recently released ) were an improvement, the decision to make it subscription only was the final straw for many faithful users. The good news is that nowadays there’s some excellent finance tools on Mac that not only do a better job, they don’t require a monthly or annual subscription to use. Some of the apps featured here are even free like the excellent which blows Quicken out of the water when it comes to investment tracking. There are also some serious value for money Mac desktop apps that can import your Quicken accounts such as the impressive.

Apart from price, other reasons the choices here beat Quicken include:. Bank Syncing: Quicken is notoriously bad at syncing with bank accounts. You’ll find the apps here that support connecting to financial institutions far more reliable. Mobile Support: Quicken’s mobile app is limited and nowhere near as useful as the desktop app. Most of the apps here have well designed iPad and iPhone apps which are clear and easy to use.

Investment Tracking: The Mac version of Quicken has never been good at tracking investments. You’ll find software here that do a much better job of managing car loans, home loan amortization, stocks, retirement funds and more. For a more specific look at investment apps, check out our look at the. Less Paperwork: By centralizing all of your accounts with some of the tools here, you should also find that they help you if you want to.

With this in mind, here then is our list of the best alternatives to Quicken for Mac in order of ranking. Is an amazing tool to manage your finances and best of all, it’s actually free to use. If you already use Intuit’s other budgeting tool Mint, you’ll really like Personal Capital because it’s got the same feel but with. Around 1.8 million people use Personal Capital and many of them have switched from Quicken, especially those with investments. Here’s a summary of why Personal Capital is such a great replacement for Quicken. Yes, hard to believe for a personal finance software worth its salt but Personal Capital is 100% free to use for as long as you want with no limitations. Personal Capital only charges you a small commission if you decide you want to maximize your investments via a personal consultation with one of its own Financial Advisors.

This is completely optional and not obligatory but is there if you want it. It syncs accounts seamlessly in one place. If you’re tired of constant syncing issues and problems with Quicken, Personal Capital is a breath of fresh air.

It syncs extremely well with all major financial institutions, aggregates your accounts and makes it easy to get an overview of your finances. This includes checking, savings, 401k, mortgage and investment accounts.

That’s not to say that hiccups don’t happen as much depends on technical changes made by financial institutions but it’s so much painless than Quicken. You can also download any transactions synced with Personal Capital in CSV format. It analyzes your investments to save you money. What makes Personal Capital different to many budgeting apps is that it also helps you save money on existing investments. One of the ways it does this is via a fee analyzer and an investment analyzer.

For example, the retirement fee analyzer immediately identifies areas where you may be getting ripped-off or over charged with 401K admin or management fees. The investment analyzer does the same for your investments to see where your existing investments and holdings can be diversified to improve your returns. It helps you plan for the future. By telling Personal Capital exactly how much income you expect to have in retirement, Personal Capital calculates exactly how on or off track you are. It can also assess the impact on your 401k of major life events such as the birth of a child, illness, college fees etc. It also has a comprehensive cost of living retirement calculator which gives you useful insights into your average net worth by age. In fact Personal Capital is easily the best retirement planning software for Mac available.

It’s as secure as any bank out there. Like any major financial institution, Personal Capital is registered with the Securities and Exchange Commission (“SEC”) and has to adhere to the same security standards and procedures. What’s reassuring about Personal Capital is that it doesn’t actually handle your log in details at all. It uses Yodlee which is a highly secure financial credentials management system used by major banks and investment institutions worldwide. This is bank level, military grade security that’s about as secure as it gets nowadays. Even if your account were somehow compromised, Personal Capital doesn’t actually allow transferring of funds to they cannot be touched anyway.

There are other measures that Personal Capital takes to encrypt and protect your data which you can. You can talk to a human if you want to. Sometimes an app just isn’t enough if you really want to grow your money. Especially if you’re investing large sums, Personal Capital allows you to consult with a Personal Capital advisor who can make specific recommendations based on your personal situation and minimize tax liabilities.

You need a minimum of $100,000 to use this service and Personal Capital charges a commission for it but for serious investors, this is a unique bonus the app. Personal Capital obviously encourages you to use one its Financial Advisors but there’s no hard sell if you’re not interested. You can check your finances on the move.

The Personal Capital iOS app is one of the best personal finance apps for iPad or iPhone we’ve tried, allowing you to manage and monitor your finances wherever you are. It’s clear, easy to use and has lots of features compared to most mobile budgeting apps. The only big gripe we have with Personal Capital is that you can’t import Quicken QIF or QFX files which is disappointing if you have years of Quicken accounts. Another slight drawback is that it doesn’t help you much at tax time. Although there’s dedicated for this, there seems little reason why Personal Capital can’t make things easier when it comes to declarations. Overall though, Personal Capital not only helps you budget better but it manages your investments too and it’s so convenient to have that all in one app. For more information, you can check out our full.

You can also to judge for yourself. Pricing: Free. If Cloud based apps are not your thing and you want a dedicated Mac desktop app, (formerly Fortora Fresh Finance) is an excellent no-nonsense personal budgeting software for both Mac and Windows.

Moneyspire doesn’t store your accounts in the Cloud, doesn’t require you to upgrade regularly or subscribe like Quicken and you can download it onto your Mac. Even better, at the moment, compared to the normal price of $49.99 which is definitely a good deal for a desktop personal finance software for Mac on this level. You can import QIF files from Quicken and likewise, export your accounts to QIF if you move back to Quicken at a later date. Moneyspire supports online bill payments though via both and its own service both of which are free to use. Moneyspire Connect supports over 15000 financial institutions so it’s safe to say, your bank is probably supported if Direct Connect doesn’t work for any reason. Moneyspire is a very complete alternative to Quicken on Mac which tracks bank accounts, credit cards, loans, investments and more.

You can set bill reminders, budgets and generate detailed reports and charts to monitor your outgoings and if you run a small business, you can also create professional invoices and track payments. It can even print checks which most finance apps no longer support anymore on Mac.

One of the things we like most about Moneyspire is that it doesn’t over complicate things. It gives a very clear overview of everything from accounts and details of spending to bill reminders and budgets. The Bill & Deposit Reminder provides a very clear overview of upcoming payments: You can generate detailed reports and charts to see exactly where your money is going to make tax reporting less stressful and much easier. Other useful features in Moneyspire include Balance Forecast, Reconcile Statements, Online Banking, Import & Export of Data and Cloud syncing. If you’ve got a lot of accounts saved in on Windows, Moneyspire can also import MS Money files. For mobile users, there’s a free which allows you to check your account balance, see upcoming bills and keep an eye on how your budget is doing. Moneyspire used to be available in different versions but has now simplified its pricing policy and there’s now just which includes Direct Connect access.

Normally it retails for $49.99 but it’s currently offering a 40% off deal. The impressively reliable Moneyspire Connect service is even included in the price (which previously used to cost an extra $49.99 per year). If you do decide to purchase it, you have a 60 day money back guarantee if you’re not happy with it. Unlike with Quicken, updates to Moneyspire are free but major updates usually require an upgrade fee. You can also if you want to see what it’s like for yourself. Pricing: $29.99 (Normally $49.99) – Free Trial. (formerly iBank) is designed specifically for Mac and has long been one of the most popular desktop replacements for Quicken on Mac.

Long before Quicken for Mac, Banktivity supported things like online banking integration, bill pay, envelope and full year budgeting, loan amortization and multi-currency support. Some of these things have now been introduced in the latest version of Quicken 2018 for Mac but Banktivity still remains an excellent personal finance app for macOS. Here are some of the things we like the most about Banktivity:. Account Importing: Banktivity will import your accounts from Quicken and other finance software. Although it’s not perfect, the import tool does a pretty good job and saves valuable time manually entering old accounts. You can see how this works below. Bank Syncing: Banktivity will automatically connect to and download transactions from your bank or other financial institution in real time.

It offers various ways of doing this with the most reliable and widely supported being Direct Access. Direct Access is Banktivity’s own syncing service and generally works very well although it costs an extra $44.99 on top of the cost of Banktivity. Other free ways of connecting are available though.

Detailed & Customized Reports: The reports generated by Banktivity are very well-organized due to tags and categorization. There are Quick Reports for instant overviews of the essentials and you can create highly customized reports for virtually any kind of spending. Budgeting: Banktivity supports traditional and envelope budgeting with useful setup wizards to get you going. You can filter budgets by time frame to see exactly when you’ve gone under or over budget and set budgets for scheduled and unscheduled expenses. iPad, iPhone and iWatch Apps: Banktivity is designed exclusively for the Apple ecosystem with to help you monitor and enter transactions on the move. The apps sync with the desktop version of Banktivity and there’s even an iWatch app with spending alerts to help keep you on budget. Investment management isn’t Banktivity’s strong point but there is a separate free (formerly iBank Investor) which syncs investment data specifically.

So for example, you can see all of your holdings with the current gains or losses in real time with data pulled from Yahoo Finance. Banktivity 6 costs but you must pay an additional $44.99 per year for Direct Connect access. You can also true a. For a more in-depth look, you can also read our full.

Has many satisfied customers that previously used Quicken and is an excellent desktop equivalent to Quicken on Mac. Moneydance has all of the features of Quicken including online banking and bill payments, bill attachments and arguably has better investment tracking and budgeting tools than Quicken. Moneydance is particularly good at handling investments and transactions in multiple currencies so is an excellent choice for those that hold investments or make purchases in currencies other than US dollars. Moneydance provides a very clear overview of your finances.

It gives you all the essentials such as account balances, upcoming and overdue transactions and exchange rate information. The calendar overview is particularly useful for a quick oversight of upcoming credits and debits so you can manage your finances for that month more easily. Moneydance can import Quicken files in QIF format although we noticed several duplicate transactions which had to be manually adjusted. Moneydance can automatically download transactions and make bill payments online to hundreds of financial institutions. However, online banking is only available via Direct Connect and we found this can be tricky to setup in Moneydance. Moneydance can sometimes be unreliable at retrieving bank data especially from credit card accounts and there’s no enhanced online bank connection service that you can pay extra like with Moneyspire and Banktivity. Investment tracking is also easier to navigate and more powerful than Quicken, with support for stocks, bonds, CDs and mutual funds among others.

You can see the total value of your investments or the performance of individual stocks and mutual funds over time. Moneydance will also download stock prices automatically in real time. Moneydance also has some powerful reporting tools that compare favorably with Quicken and it can generate reports for any of your accounts, savings or investments. The are both free so you can manage your budgeting on the move although it’s only really useful for manually inputting transactions.

Slightly concerning though is the fact that Moneydance only syncs the Mac and iOS app via Dropbox which doesn’t feel very secure compared to Banktivity’s encrypted Direct Access features. You can also extend its functionality with add-ons and extensions for such things as a Balance Predictor, Debt Insights and a Find and Replace extension. Overall Moneydance is a solid financial software for Mac to replace Quicken especially if you need reliable online banking integration.

From the Mac App Store with a 90 day money back guarantee and there is also a free Moneydance demo for up to 100 transactions. Pricing: $49.99 Mac App Store is owned by Intuit the makers of Quicken and is basically a free, lighter and less powerful version of Quicken. The biggest difference between Mint and Quicken is there is no automatic online bill pay feature in Mint so if this is a deal breaker for you, move on. Mint has improved a lot over the years and has faced less criticism than Quicken, partly because it doesn’t cost a cent to use. In fact many people to manage their finances. Mint is all about getting your money in order and is based around three things:. Budgeting: Mint will automatically suggest a budget for you based on your income and goals.

You can factor in one off expenses and of course recurring monthly costs. Bill Tracking: All your bills are clearly labelled and managed in one place. You can see when bills need paying and set alerts to let you know before they’re overdue. Credit Score Analysis: Mint performs a free credit score analysis if you verify your identity. It also gives you recommendations on how you can improve it. Spending Summary: You get a weekly summary of where your money has gone.

This is useful for seeing which areas you’re spending most in and is handy to compare month-by-month. Mint will also alert you to unusual or large transactions. Spending by Category: Mint can also categorize transactions to make it clearer where you spent your money. If you’ve ever looked through your bank statement and can’t understand the codes and jargon used for certain transactions, this is useful.

It also separates ATM withdrawal amounts from ATM withdrawal fees so you can see just how much your spending in charges and other hidden fees. Investment Tracking: The investment tracking features in Mint are very basic and certainly nothing like the financial tools in Personal Capital but for 401(k) accounts, mutual funds and IRAs it gives a basic overview. Mint also has one of the best out there for budgeting. The Mint iPad and iPhone app looks good, gives a clear overview of your finances and is easy to navigate. The biggest problem you”ll encounter with Mint is connecting to banks to update your accounts.

Like many personal finance apps, Mint can take time to update your balances and transactions and can be affected by changes made by your bank to the way third-party apps communicate with it. Sometimes this means you have to delete an account in order to reconnect it and the problem with this is that you lose your account history in Mint. It’s also important to note that although Mint and Quicken are both Intuit products, there is no integration between Quicken and Mint. They are completely separate products. Overall however, as a more basic free alternative to Quicken, Mint is an excellent budgeting tool for Mac users.

Pricing: Free. Is designed specifically for Mac and used to be the closest thing you could get to Quicken before Intuit finally released Quicken for Mac. Despite the launch of Quicken, the makers have continued to develop SEE Finance into a very reliable, robust and feature packed personal budgeting app for Mac.

In fact the latest version of SEE Finance 2 has been built from the ground up and is a big improvement on in terms of both looks, functionality and affordability. We found that SEE Finance 2 is one of the best personal finance software for Mac when it comes to importing Quicken QIF data accurately. Unlike apps such as Banktivity and Moneydance, there’s less chance of duplicated transactions when importing large QIF files into SEE Finance. You can import files in QIF, QMTF, CSV, QFX and OFX format. Investment tracking is also very well done in SEE Finance 2 with a clear and varied overview of your investments with lots of different reports. SEE Finance 2 is also very good at handling multiple currencies with over 150 different currencies supported.

You can connect to banking institutions via Direct Connect which will automatically download transactions and import data from others. This is easy to setup and use in SEE Finance and pretty reliable at syncing and updating account.

Note however that SEE Finance 2 does not support Bill Pay. More recently there’s now an for iPhone and iPad that syncs with the Mac version via iCloud. It also works with OFX Direct Connection downloads if your bank supports it. SEE Finance 2 is a massive improvement on the first version and remains a fast, reliable and slick app to manage your finances on Mac.

Note that is still available in the Mac App Store but we strongly recommend using instead as it’s far more modern, includes an iOS app and is more likely to be supported by the developer in the future. You can also try a. Pricing: $39.99 – Free Trial Although You Need a Budget can’t fully compare with Quicken, if it’s mainly budgeting you use Quicken for, it’s definitely a contender. YNAB that new users save on average $200 in their first month and more than $3000 by month nine although this of course won’t be true for everyone. Because of the way it approaches budgeting, YNAB has proved very effective at helping users to save money and get their finances in order which is made it very popular with Mac and PC users alike. More recently, it’s now added online banking support via Direct Connect to conveniently sync and update all of your accounts and transactions in one place so you can keep tabs on your money better. There is no support in YNAB for Bill Pay however.

The developers of YNAB strive to help you manage your money more efficiently by encouraging you to use a which can genuinely help you save money or get out of debt. The four golden rules are:. Give Every Dollar A Job: Every cent is accounted for. Embrace Your True Expenses: Break down large purchases into monthly payments. Roll With The Punches: Create an overflow for the unexpected. Age Your Money: Deal with bills as they happen YNAB is structured around these four principles and helps you to structure your budget accordingly. YNAB can and can retrieve your balances from over 12,000 banks.

Note that there’s no support for Direct Connect or Bill Pay though. YNAB also does not support multiple currencies or investment tracking so it’s not really suitable for those who have a big investment portfolio.

It does however allow you to factor mortgages and simple investments into your overall budget and gives you a very clear overview of where your money is going. YNAB is also one of the only personal finance apps that has an but even more unusual, an which can automatically check category balances or record new spending at your command. Although across all devices, note that it uses Dropbox for syncing and doesn’t offer its own Cloud syncing service or syncing via iCloud. YNAB now costs $4.99 a month or $49.99 per year direct from the developer. If you’re a US college student,. You can also try a of YNAB before deciding whether its for you or not.

If you’re struggling to make ends meet at the end of the month, YNAB is an excellent straightforward budgeting alternative to Quicken. Pricing: $49.99/Year – Free Trial. Is a simple but effective budgeting app that can import Quicken QIF files and Mint files. The Quicken import tool is one of the best we’ve tried and accounts are imported with very little need for manual adjustment. CountAbout automatically downloads transactions from your bank including investment balances like 401k’s.

There is no support for Bill Pay though. CountAbout offers two subscription plans – one for $9.99 per year and a premium subscription for $39.99 per year. The difference is that the Premium subscription includes Direct Connect which allows you to automatically download transactions from bank, credit card and investment institutions. CountAbout is very good value for money and considerably cheaper than most personal finance software that supports Direct Connect.

You can see a quick overview of what CountAbout can do below. Pricing: $9.99/year or $39.99/year with Direct Connect. Is a slick, simple but effective Quicken alternative designed specifically for Mac. MoneyWell is unique in that it uses an to help you manage your finances better. Rather than setting targets that you either hit or miss, envelope budgeting works on the basis that any money you save or overspend is constantly adjusted to show the effect on your incoming bills.

MoneyWell also supports Direct Connect so that you can automatically pay bills from your bank account. MoneyWell is clearly well thought out with some really smart interactive reports. In fact the graphs and reports in MoneyWell are some of the best we’ve seen in any budgeting software at this price. Unfortunately, there’s no longer a mobile app though. MoneyWell Express was the mobile version of MoneyWell but was discontinued in early 2018 due to syncing issues.

MoneyWell costs $72.60 but you can also. Pricing: $72.60 – Free Trial.

Finally, if you’re looking for something that can double as both a budgeting app and, might be for you. MoneyWorks was one of the first ever finance apps for Mac and made its debut on OS X way back in 1992 – before Windows 95 was even invented. If you’re a treasurer and use Quicken to keep track of your organization or company budget, MoneyWorks may be ideal for you as it’s designed for small businesses, organizations and accountants in mind. MoneyWorks can import data from QuickBooks, MYOB, Xero and Greentree although it doesn’t support importing Quicken data. MoneyWorks also doesn’t support Direct Connect or Bill Pay though so it’s not suitable for those that want to sync it with their bank. MoneyWorks is however well-integrated with other business software on Mac including Daylite, FileMaker, Numbers and Microsoft Office.

If you need something that can manage payroll, CRM and, then MoneyWorks is a particularly good choice. MoneyWorks is also generally very good at representing complex business data in graphs and produces custom reports via the MoneyWorks Gold report writer.

It’s also a good option for those that need to share their accounts with Windows-based accountants as it works on both Mac and PC. MoneyWorks comes in aimed at differing sizes of business and all are available for standalone purchase or via subscription.

MoneyWorks Cashbook is completely free to use and is ideal for small organizations that need a simple financial management solution. You can also for 45 days. If you’re looking for a Quicken alternative with a focus on accounting and cashflow, MoneyWorks is a powerful solution for Mac users Pricing: Free/$18 per month+/$249+. Which Is The Best Quicken Alternative For Mac? If you’re looking to maximize your investments as well as manage your budget, then is still the best of the lot. It just makes budgeting and maximizing your assets so easy and looks great on Mac. However, the current deal makes it a great option for those that want a dedicated Mac finance software without any subscriptions or Cloud storage of your finances.

Considerations When Replacing Quicken The best alternative to Quicken really depends on your specific needs. Some people need things like Bill Pay and Online Banking while others are more focused on investments. To help you in your decision though, here’s a checklist of features to bear in mind when deciding which Quicken replacement to choose. You can see whether the application you’re interested in supports these features by checking the comparison table above. Online Banking Integration This is essential for those that want their accounts to be regularly updated with real time bank transactions. (known as in Quicken products) is the standard method that most banks support although increasingly, users are finding it very unreliable.

Sometimes this is not an application’s fault and is due to changes made by banks on how third party software connects to them. Some banks such as Citibank have even dropped support for Direct Connect in favor of their own proprietary system instead.

As a result, some applications such as Moneyspire, Banktivity and Moneydance have developed their own version of Direct Connect although this usually costs extra. However, Moneyspire’s reliable service is now included for free in the price of the product which makes it a very good deal indeed.

Note that some banks may levy a small charge for connecting your account to a third-party app via Direct Connect so it’s always wise to check with your financial institution first. Bill Pay It’s important to be aware that just because an app supports online banking, doesn’t necessarily mean it supports Bill Pay. Bill Pay enables an application to automatically pay your bills to help keep on top of them.

Of course, you can do this easily by setting up a Direct Debit with your bank for things such as utility bills but Bill Pay enables your finance app to track them more easily. Encrypted Connections When it comes to security, remember that any connection made between finance apps and your bank are only as safe as the application accessing it. Make sure that the application takes security seriously and uses encrypted connections to your bank to prevent unauthorized interceptions. A few apps such as Personal Capital add an extra layer of protection by not actually storing your financial credentials but managing access via specialized encrypted service Yodlee.

This is also used by many financial institutions and adds an extra layer of protection to your data. Investment Tracking This is essential to track loans, assets, stocks, shares and bonds etc. One of the big gripes Mac users have with Quicken is that it doesn’t do a good job of tracking basic things like car loans or home loan amortization (although fixed interest rate tracking was introduced in Quicken 2017), Alternatives such as Personal Capital, Banktivity and Moneydance all feature investment tracking as standard. Mobile Apps If you like to manage your money or check accounts on the move, make sure the software you choose has a mobile app. Most apps that have a mobile app sync accounts with your iPhone or iPad although many are limited in functionality and don’t allow you to make many transactions. Some user their own servers to sync while others offer syncing via iCloud. If you like to take photos of receipts and invoices to sync with your Mac later, make sure this feature is supported.

Can't Reconcile Manual Transaction In Quicken For Mac 2017

Quicken Import Support If you want to import your Quicken accounts into another application, you can easily do so by exporting them into QIF format. However, not all personal finance software supports QIF importing so if this is important to you, make sure you can migrate from Quicken easily. Note that no Mac personal finance app will import Quicken files 100% perfectly – there will always be some manual correction necessary. Multiple Currencies For those that travel a lot or that deal with foreign transactions regularly. The Mac edition of Quicken is still lagging behind when it comes to multiple currency transaction support.

Can Reconcile Manually Transactions In Quicken For Mac

Those that imported foreign currency accounts into Quicken 2018 for example found that they were suddenly converted to dollars. Make sure foreign currencies are supported if you do a lot of trade abroad to avoid some major headaches when importing data. User Profiles If you share the software with a partner, other members of your family or colleagues, support for creating multiple profiles is very useful. It allows you to track spending and create budgets for each individual member whilst also preserving the privacy of each user. Some financial software only allows one user per license and some don’t support more than one profile so bear this in mind if you’re intending to use the program with other.

We hope this article has helped you be more informed when choosing a replacement for Quicken on your Mac. This is by no means a definitive list of programs to replace Quicken with on your Mac. There are other options (examples include and ) but we haven’t included them as most are now very dated and can’t compare to the latest version of Quicken anymore.

If you have any other questions, experiences or suggestions regarding the software featured here, let us know in the comments below. You May Also Like:. Smayer97 Why not still list the original Quicken for Mac 2007? It is still available for only $15. Though it may be old, it is feature rich and has many capabilities, works PPC & Intel, from OS 9 through OS X Mavericks (OS X 10.9). Though it may be dated and missing some modern features, it is still the best out there that is still available.

It can be downloaded here: or here: Note that a new version is actively in the works (in beta testing right now), based on Quicken Essentials but more feature rich that will become more comparable to Quicken for Mac 2007. Smayer97 That information is incorrect. Yes, there was a problem that took a week or 2 to fix. Most financial institutions now have been fixed. That said, there are several institutions where the problem persists. BUT all of this has been a coincidence. The root problem, in great part, is due to the fact that a hole in the SSL security protocol was found in Sep 2014 and many companies updated (readturned off) their security protocols which has made them incompatible with Quicken 2007 and older.

(do a search on POODLE and SSL to learn more). So at this time, most Quicken 2007 users are ok again, though some still experience some problems. Quicken 2015 has filled in the gapthere are still many shortcomings with this version that make in impossible for many users to move to this new version, but Intuit at least now has a dedicated team to move the product forward. Only time will tell if they sustain the momentum they have finally achieved. Smayer97 I agree with your concerns.

That said, I have yet to find an alternative that handles data as well as Quicken 2007, though it still has limitations. A lot of what others offer may look nice, but a lot is stuff I have not significant need. So far, none other can handle my data the way I need it. At least recently, Intuit hired a new team to work on making significant updates to Quicken for Mac.

Hopefully they will deliver. Seeing behind the scenes (being involved with beta testing) they have a lot of good stuff planned AND in the works. Only time will tell. For now, Quicken 2007 still is the best option for me.

It may still be for others too. And since it is still available, though not widely publicized, it should still be presented as a viable option, with caveats.